Let us face this.

The aim of a business enterprise is to create stakeholders’ value. In most cases, value culminates in the form of revenue, revenue growth, profitability, profitability growth, and market share – in comparison with competition and industry growth. It is a no-brainer that prudent finance management is the hallmark of great organizations. Organizations that consistently deliver superior program & project profitability rely on robust project finance management software.

How does a top-rated project financial management tool add business value?

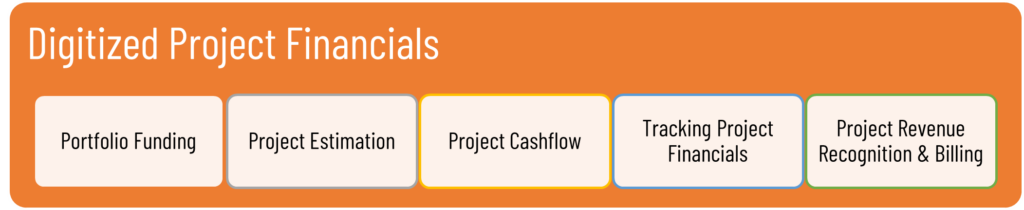

Let us make it very clear – the foundation of a world-class project finance management software must be built on ‘digitalization’ of the end-to-end process. Now let us review the top five benefits.

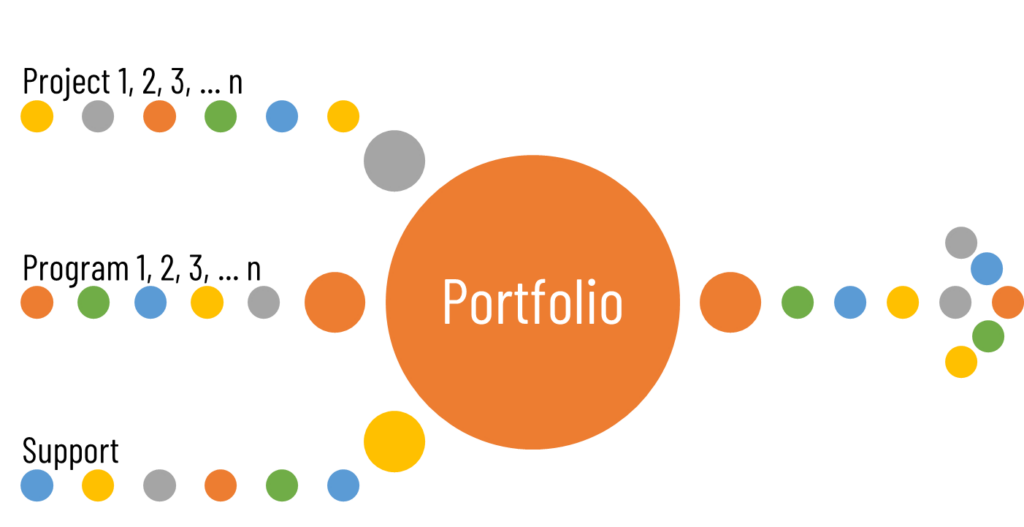

1. Project Investment Decisions & Portfolio Management

Among various decisions that leaders make, the toughest ones are those for investment allocation for projects and programs. Most organizations continue to rely on spreadsheets to document, analyze, and decide project funding. Relying on spreadsheets is akin to walking on a minefield, where small (difficult to detect) errors could prove to be fatal. With a solid project finance management software, business leaders can perform thorough estimations of costs and forecast revenues. The in-built rigour of the financial processes offers decision-makers with data-driven confidence along with control mechanisms.

2. Enterprise Budget Management

After project funding, the next dimension of financial decision-making involves developing and approving budgets for various projects and programs. The program and project profitability are tightly coupled with enterprise budget management. Again, reliance on spreadsheets leads to inefficiency as well as data-quality issues, not to forget managing budget revisions. Meticulous finance management hinges on an enterprise budget management software, that can be configured to the specific needs of your industry and organizational standards and processes. With in-built workflows linked to financial processes, business leaders gain greater control in enterprise budget management.

3. Program & Project Cost Estimation & Cashflow Analysis

Program and project planning involves granular planning – from deliverables to work-packages to activities to tasks, and finally to sub-tasks. Not doing so would put the program and project profitability into jeopardy.

A well-designed project financial management tool can integrate a project work breakdown structure with resources, effort, and finally the costs. When connected, program and project budgets are no longer a burden. Additionally, managers can easily visualize cashflow (inflow and outflow). With provisions to revise budgets based on business needs, managers can manage multiple project financial baselines – and laying a strong foundation for project financial tracking and control.

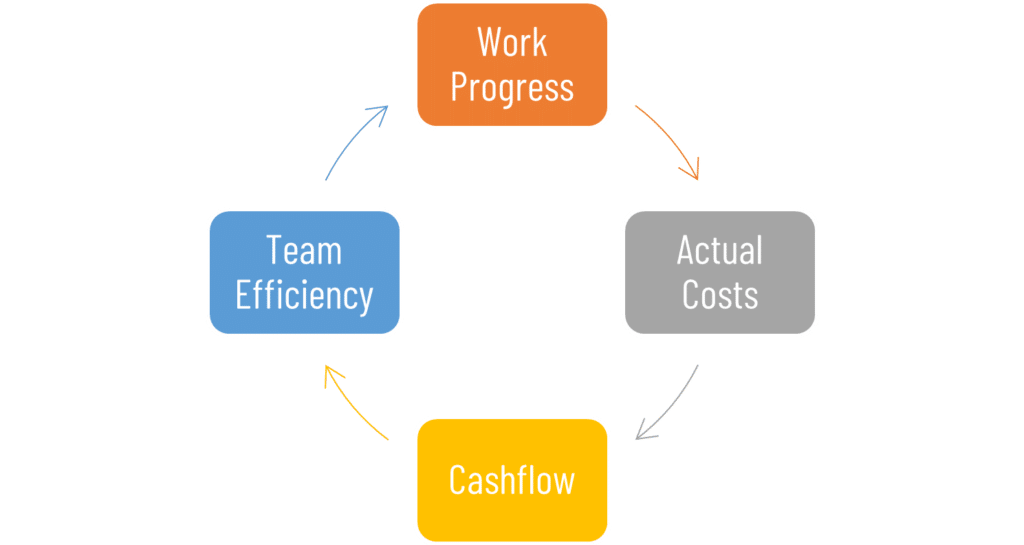

4. Project Financials Tracking

Strategies and plans may be great. But value realization depends on ‘flawless execution.’ It is critical that managers track the financial performance at various levels – task, work packages, milestones, and project! However, most project management solutions do not offer robust and inbuilt project financials.

With a strong project finance management software, managers can integrate project progress with actual costs that are linked to project budgets. Further, funding limits can be set up to ensure that the costs and cashflow are closely aligned. With the ability to track the team members’ actual effort, managers can analyse and manage the team’s project financial efficiencies.

Program & project managers can proactively manage both costs as well as cashflows to ensure project fiscal discipline – keeping profitability intact.

5. Project Revenue Recognition & Invoicing

There are two stages of projects value realization.

The first stage is revenue recognition based on customer acceptance of project deliverables. A top-class project financial management tool integrates project progress with revenue recognition making life easy for business leaders. Imagine the chaos when project progress and revenue recognition are tracked and managed separately. Corporate hell is not very far! Added to this is the complexity of different rules associated with revenue recognition based on contract types such as fixed price, cost plus, time & material and combinations thereof.

The second stage is raising customer invoices. Conflicts due to mismatched work completion and customer billing – between the project team and the finance teams. It requires a lot of financial reconciliation before matters are sorted out. With a top-class project finance management software, rules can be defined to link work completion and raising invoices and automate invoice generation.

A top-class project finance management tool within an overall project management solution makes revenue recognition and customer invoicing a breeze!

A summary of benefits of using a project finance management software within a comprehensive project management solution such as ProductDossier PSA –

- Digitized project financials management.

- Robust project funding / investment decisions.

- Meticulous and integrated enterprise budget management.

- Thorough project estimation and cashflow management.

- Proactive project financials tracking.

- Automated revenue recognition and customer billing.

ProductDossier PSA Project Financials is designed to deliver financial discipline for your enterprise.

Are you ready?