Blog Highlights

- The new product development process in pharma from discovery to post-approval, with emphasis on where value shifts from scientific risk to execution risk

- The gap between regulatory approval and operational readiness, and how this gap drives post-approval delays

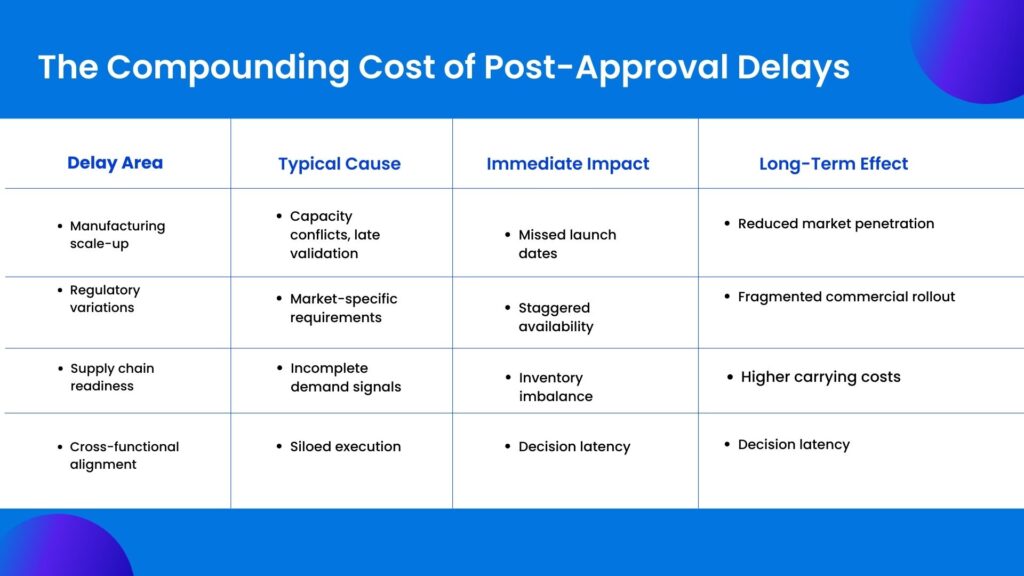

- Post-approval product development across manufacturing, regulatory, supply chain, and commercial functions, and the coordination challenges between them

- The accumulation of small execution decisions that quietly stretch timelines after clinical approval

- The financial and strategic cost of post-approval delays, including revenue loss, capacity waste, and portfolio drag

- The new product development NPD process as a continuous value system shaped by portfolio pressure, execution visibility, and outcome-focused measurement

Clinical approval should feel like relief. Years of uncertainty finally narrow into a clear signal. The science has held. Regulators have agreed. The molecule is real. Yet inside many pharma organizations, approval does not bring momentum. It brings tension. Calendars fill, dependencies multiply, and what should be a disciplined march to market turns into a slow negotiation between teams that were never designed to move in lockstep.

The uncomfortable truth is this. Many pharma products lose more value after approval than before it. Not because the science failed, but because execution faltered. The new product development process does not end at regulatory clearance. It enters its most fragile phase.

This is where timelines stretch quietly. This is where accountability diffuses. This is where leaders discover that success in clinical development does not automatically translate into speed, scale, or commercial impact.

This blog examines the new product development process in pharma from that inflection point forward. Not as an abstract framework, but as a real operational system with measurable consequences. Especially when it breaks.

What Is the New Product Development Process in Pharma?

At a surface level, the answer seems straightforward. The new product development process begins with discovery, moves through preclinical research, advances into clinical trials, and culminates in regulatory approval. This is the version most professionals learn early in their careers.

In practice, the new product development process in pharma is less a sequence and more a network. Each phase overlaps with the next. Decisions made early ripple forward in ways that are not always visible at the time. Manufacturing assumptions shape clinical timelines. Regulatory strategies influence commercial readiness. Portfolio priorities alter resource availability midstream.

When leaders ask, what is the new product development process in pharma, they are often asking the wrong question. The more useful question is where value is created, preserved, or lost as the product moves from concept to patient.

Approval is not the end of development. It is the moment when scientific risk gives way to operational risk.

Regulatory Success Does Not Mean Operational Readiness

Regulatory approval confirms the science. It does not confirm readiness. Approval validates safety, efficacy, and compliance. It does not test whether the organization can deliver at scale. That distinction matters more than most teams admit.

Manufacturing processes may behave differently outside pilot conditions. Suppliers that supported clinical volumes may struggle at commercial scale. Packaging and labeling plans often break when extended across markets. None of this is fully stress-tested before approval.

Regulators do not assess execution speed. They do not evaluate decision velocity, ownership clarity, or cross-functional coordination. Yet these factors determine how fast a product reaches patients.

What appears as a post-approval delay is often delayed discovery. The system was fragile long before approval. The pressure simply revealed it.

In the new product development process, readiness is not a milestone. It is a capability. Organizations that treat it otherwise pay for that assumption later.

The Often-Ignored Half of Product Development

Once a product receives clinical approval, the work does not simplify. It fragments.

Manufacturing teams move from pilot to scale. Quality groups manage validation and ongoing compliance commitments. Regulatory affairs handles variations, labeling updates, and market-specific submissions. Supply chain plans inventory, cold chain logistics, and distribution sequencing. Commercial teams prepare launches that depend entirely on everything upstream holding firm.

Each of these activities is legitimate. Each has its own constraints. The problem is not complexity. The problem is coordination.

The new product development NPD process in pharma becomes most vulnerable precisely when it spans the most functions. Post-approval execution exposes the organization’s true operating model. If planning, ownership, and visibility are fragmented, delays become inevitable.

The Organizational Handovers That Slow Pharma Product Development

Pharma product development slows not because teams disengage, but because ownership shifts. As products move from clinical development to approval and then to launch, responsibility passes across functions. R&D hands over to manufacturing. Manufacturing coordinates with quality. Commercial teams prepare in parallel. Each transition introduces friction.

These handovers are rarely designed as transitions. They are treated as exits. Once a phase is “complete,” teams move on. Context is lost. Assumptions made earlier are no longer visible. Decisions that were reasonable in one phase become constraints in the next.

In the post-approval stage, this fragmentation becomes more pronounced. Manufacturing focuses on scale and validation. Regulatory teams manage variations and commitments. Supply chain plans inventory and distribution. Commercial teams push for readiness. Each group operates with its own timelines and success metrics.

The problem is not effort. It is alignment. No single team owns the space between functions. Dependencies are managed informally. Issues surface late, often when options are limited.

Where Pharma Product Development Timelines Actually Break Down

Delays after approval rarely announce themselves. They accumulate.

One dependency slips. A validation batch is reprioritized. A labeling update takes longer than expected in a secondary market. None of these events, in isolation, feels catastrophic. Together, they quietly erode launch windows.

A common failure point is siloed planning. R&D exits the picture with a sense of completion. Manufacturing operates on its own cadence. Commercial teams forecast demand without real-time feedback from supply. Leadership sees progress through summarized reports that flatten risk.

Another issue is static planning. Many pharma organizations still rely on plans that assume stability. Regulatory environments are anything but stable. When change occurs, plans are revised manually, often too late to prevent downstream impact.

The most damaging breakdown, however, is ownership ambiguity. When no single system connects strategy, execution, and accountability, responsibility diffuses. Delays are explained, not resolved.

This contrast is not about sophistication for its own sake. It reflects the difference between managing what is planned and managing what is unfolding.

The Real Cost of Delays After Clinical Approval

The financial impact of post-approval delays is often underestimated because it is distributed. Revenue loss is obvious, but it is not the only cost.

Every day a product is delayed, forecasted revenue shifts right. Manufacturing capacity sits underutilized. Inventory plans become speculative. Marketing spend loses alignment with actual availability. Teams remain locked into one product longer than planned, slowing progress on the rest of the pipeline.

There is also a strategic cost. Repeated delays weaken confidence. Internally, teams begin to expect slippage. Externally, partners and investors recalibrate expectations. Over time, the organization becomes more conservative, not because the science is weaker, but because execution has proven unreliable.

These costs compound quietly. They rarely appear as a single line item. But they shape outcomes.

Why Portfolio Pressure Amplifies Post-Approval Delays

Delays rarely come from one product. They come from too many. Approved products compete with late-stage assets for the same resources. Manufacturing lines. Specialists. Quality bandwidth. Attention shifts toward what is next, not what is approved.

Each trade-off seems reasonable. A batch moves. A validation window slips. A launch sequence adjusts. No single decision looks dangerous.

The risk emerges in accumulation. Without portfolio visibility, small compromises stack up. Timelines stretch quietly. By the time delays surface, options are limited.

Portfolio pressure also changes behavior. Teams downplay risk. Reporting becomes optimistic. Escalations slow. Execution drifts.

The new product development NPD process does not operate in isolation. It lives inside a crowded portfolio. When that reality is ignored, post-approval delays become routine instead of preventable.

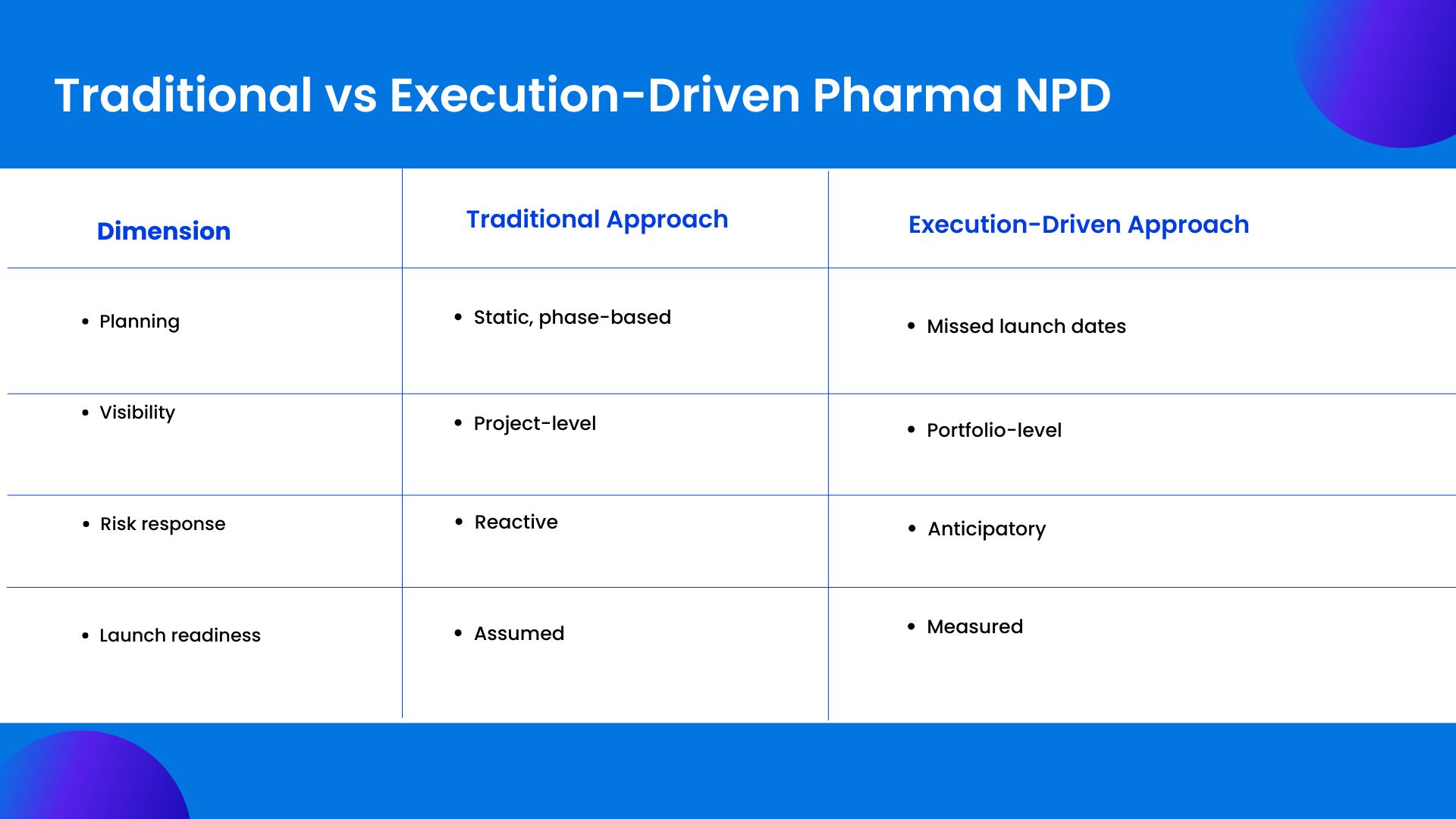

Why Traditional Project Management Models Fail Pharma NPD

Many organizations attempt to manage post-approval execution with tools designed for predictable environments. Task lists, static Gantt charts, and periodic reviews offer the illusion of control. They struggle under real-world conditions.

Pharma product development involves long dependency chains. A delay in one geography can affect global supply. A regulatory change can invalidate months of planning. Traditional tools are poor at modeling these interactions in real time.

Another limitation is perspective. Most tools focus on individual projects. Pharma leaders need portfolio-level visibility. They need to understand how one product’s delay affects another’s priority, resource allocation, and strategic importance.

Without this visibility, decisions are made locally. The organization optimizes parts of the system while the whole slows down.

What the New Product Development Process Actually Requires

An effective new product development process in pharma demands more than discipline. It demands operational intelligence.

Leaders need to see how plans translate into reality across functions. They need early signals when assumptions break. They need to understand trade-offs before they become irreversible.

This requires systems that connect planning with execution. Systems that model dependencies, not just tasks. Systems that reflect capacity constraints, regulatory variability, and commercial urgency in a single view.

Most importantly, it requires a shift in mindset. From managing activities to managing outcomes.

Still managing post-approval launches through disconnected tools?

See how leading pharma teams bring planning, execution, and accountability into one operational system with Kyte

Reframing Product Development as a Value System

The most resilient pharma organizations do not treat product development as a sequence of handoffs. They treat it as a continuous value system.

In this model, approval is a transition, not a finish line. Planning does not reset. It evolves. Teams remain connected through shared visibility and aligned metrics. Decisions are informed by real-time data, not retrospective reports.

This approach recognizes a simple truth. Value is not created when a milestone is checked off. It is created when a product reaches patients efficiently, compliantly, and at scale.

The new product development process succeeds when execution is treated as strategically as discovery.

Resource management lives in the transitions between these stages.

How High-Performing Pharma Organizations Shorten Time to Value

Organizations that consistently reduce post-approval delays share common traits.

They maintain unified ownership across the product lifecycle. Even as responsibilities shift, accountability remains clear.

They invest in visibility. Leaders can see dependencies, risks, and trade-offs without waiting for escalations.

They plan continuously. Scenarios are modeled before changes occur. Decisions are proactive, not reactive.

Most importantly, they measure what matters. Not just whether tasks are complete, but whether the product is moving closer to impact.

Measuring What Actually Matters in Product Development

Metrics shape behavior. In pharma, many teams are measured on compliance and completion. These are necessary, but insufficient.

What matters after approval is time to value. How long does it take to convert approval into availability? How predictable is the launch window? How often do plans change, and why?

When organizations track these metrics, patterns emerge. Bottlenecks become visible. Decisions improve. Over time, execution becomes a competitive advantage.

Without measurement, delays remain anecdotal. With measurement, they become solvable.

The Strategic Risk of Ignoring Post-Approval Execution

Ignoring post-approval execution is not neutral. It carries risk.

Repeated delays signal to the market that timelines are aspirational. Internally, they discourage ambition. Teams hedge. Leaders pad forecasts. Innovation slows, not because ideas are scarce, but because confidence erodes.

In an industry where pipelines are long and capital is patient, execution reliability becomes a differentiator. Organizations that master it unlock more value from the same science.

Those that do not leave value on the table.

Conclusion

The new product development process in pharma is often discussed as a journey toward approval. In reality, approval is a checkpoint. The harder work begins immediately after.

This is where operational discipline determines whether years of investment translate into patient impact and commercial success. This is where visibility, coordination, and execution either compound value or quietly diminish it.

Pharma organizations that recognize this truth do not chase speed blindly. They build systems that support intelligent execution. They treat post-approval work with the same rigor as clinical development.

That is how products reach patients faster. And that is how value is protected.

How Kytes Supports Execution-Driven Pharma Product Development

Kytes is an AI-enabled [PSA + PPM] software designed for complex, regulated product development environments. It helps pharma leaders connect strategy, planning, and execution across portfolios.

By bringing real-time visibility, dependency intelligence, and outcome-focused planning into one system, Kytes enables organizations to reduce post-approval delays and manage the new product development process as a continuous value stream. Not as disconnected phases. But as a unified execution system.

Turn clinical success into commercial reality. See how Kytes helps pharma leaders shorten post-approval timelines and protect product value.